Stop Losing Deals to AI-Powered

Due Diligence Teams

While you're drowning in data rooms, top PE firms like Blackstone and KKR are using AI to evaluate deals 50% faster, uncover hidden risks earlier, and reduce advisor costs by millions.

The Due Diligence Crisis

Due Diligence is Becoming Increasingly Challenging

Accenture's 2024 PE leaders survey reveals that 83% consider their current DD process suboptimal. Here's why traditional due diligence is failing in today's market.

Information Overload

Global data volume doubles every 2 years, with data room sizes increasing accordingly. Most growth comes from unstructured data that's not easily analyzable.

• Significantly less time to analyze

• Multiple advisors working in silos

Increasing Competition

More buyers and capital chasing fewer top opportunities, with sellers using shorter exclusivity periods as negotiation tactics.

• Cultural, cyber, environmental risks

• Information asymmetry challenges

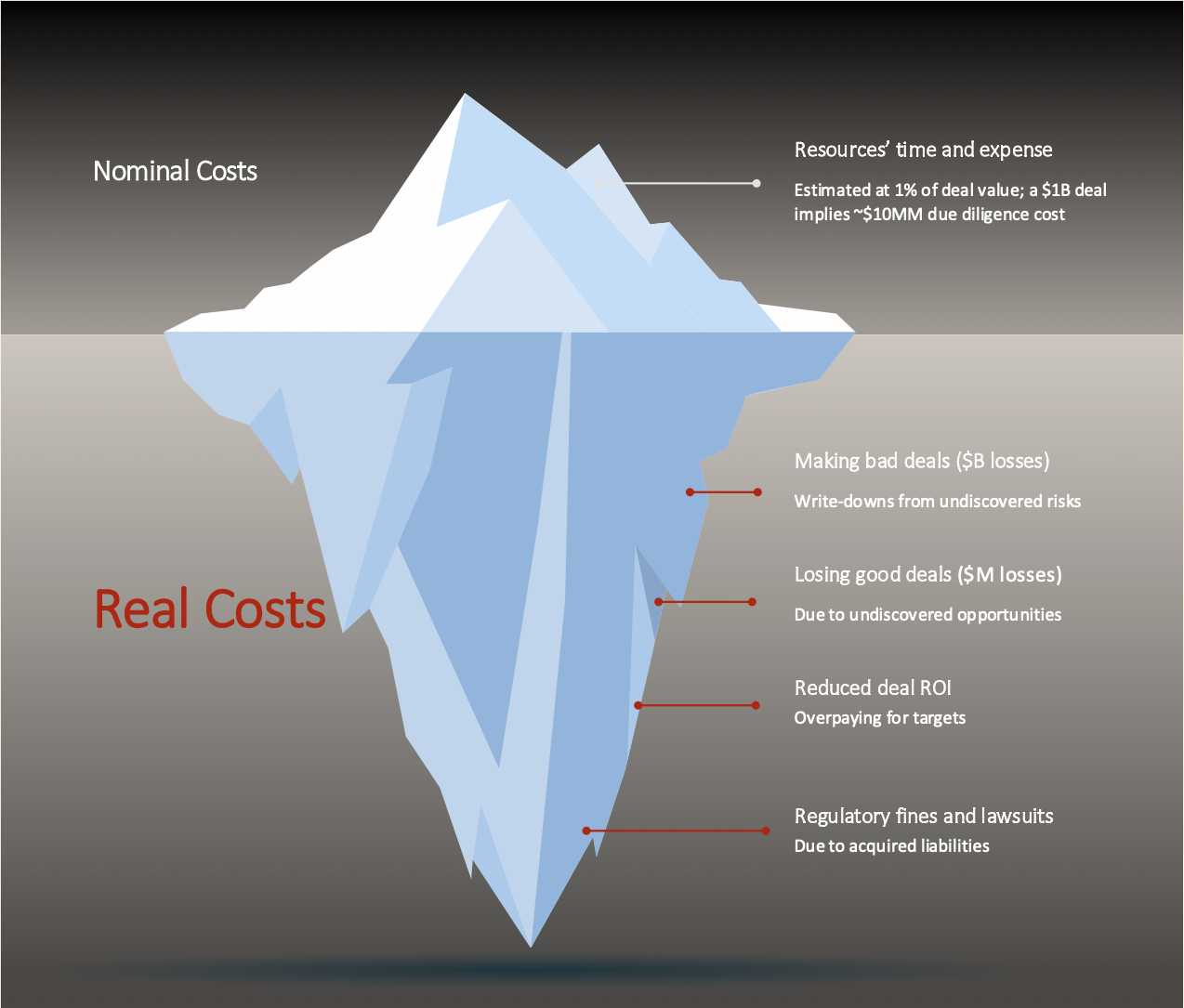

Hidden Real Costs

The visible 1% of deal value in DD costs is just the tip of the iceberg. Hidden costs from bad deals and missed opportunities are far larger.

• Missed opportunities → lost deals

• Strained internal teams

Impact on M&A ROI and Team Satisfaction

AI is Redefining Winners & Losers

Accenture estimates that >30% of due diligence activities can be automated while >20% can be augmented thanks to generative AI. Top firms are already moving.

Winners Use AI for Smarter & Faster Decisions

Leading Firms Already Using AI:

Others Held Back by Outdated Methods

Introducing VDRbot

A 100% private, secure, 'grounded in facts' bot retrieving pointed and structured insights from your diligence data room. Breeze through discovery; focus on decisions.

Key Features

Instant Retrieval

From 1000s of files in your data room, providing holistic answers to your team's discovery questions

Structured and Logged

Each answer properly structured and stored, facilitating recall, avoiding costly reports/slides

Backed by Citations

Receive accurate insights grounded in facts with no hallucination, along with citations from your data room

Secure & Private

Totally confined end-to-end to your own virtual private cloud with state-of-the-art security controls

AI-Assisted Due Diligence Benefits

Imagine Your Firm...

Competing at the Top Level

Move faster and make smarter decisions like top M&A players. Bid better on the best opportunities and reduce investments on bad deals with deeper insights into risks & opportunities.

Lower Costs

Cut reliance on external advisors and consultants. Empower your internal teams to handle due diligence efficiently, even without deep M&A experience.

Built by a Seasoned M&A Operator

VDRbot is created by someone who understands your challenges firsthand - a practitioner who has lived through the pain of traditional due diligence and built the AI solution you need.

Credentials

Vyas Tungaturti

M&A Operator & AI Practitioner

"I've seen firsthand how traditional due diligence fails deals. After 16 years in M&A and building AI solutions, I created VDRbot to solve the problems I lived through every day."

Currently based in Spain, travels to US and India for work

Don't Let AI-Powered Competitors Leave You Behind

While Blackstone, KKR, and Carlyle are already using AI to win deals faster, you're still stuck with manual processes. The gap is widening every day.

Direct Line to Vyas

Talk M&A, AI, and due diligence

Schedule a Call

Email for Demo

See VDRbot in action

vyas@vdrbot.com

ROI Calculator

Quantify your savings

Download Now

Free consultation • No commitment • See results in your own data room